VIB's shareholders approve 35% dividend payment, VND12.2 trillion profit in 2023

16/03/2023

Vietnam International Bank (VIB) held its 2023 General Meeting of Shareholders (AGM) in HCM City on March 15. During the event, the bank’s shareholders approved a plan to pay dividends at 35 per cent, including cash dividends and bonus shares. They also agreed a pre-tax profit target of VNĐ12.2 trillion set for 2023.

The VIB’s 2023 General Meeting of Shareholders took place in HCM City on March 15

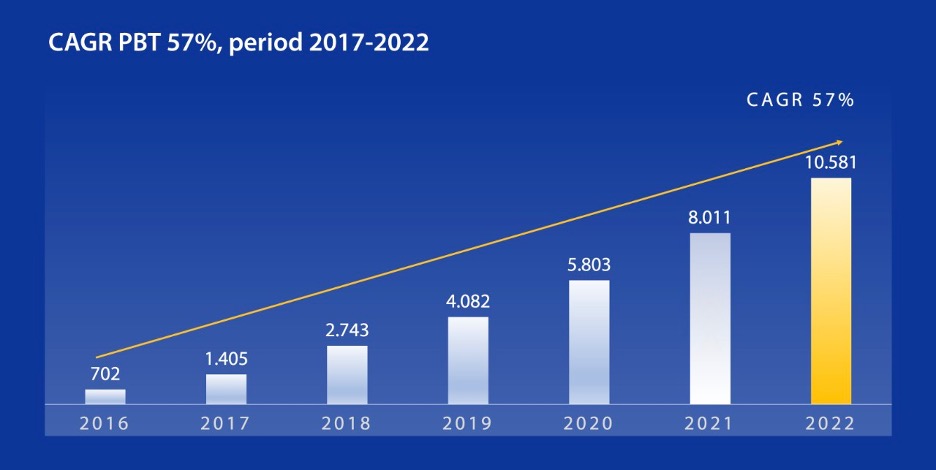

Profit increased 15 times with an average growth of 57 per cent/year, affirming its leading position in business efficiency in the industry

VIB has established a solid foundation for outstanding growth in scale, quality and brand value during the first six years of the 10-year strategic transformation roadmap (2017-26), according to the report delivered by the Board of Directors at the event. That has helped VIB become one of the leading banks in terms of business efficiency, asset size and revenue growth, effective cost management, and tight risk control. VIB's profit has grown at an annual compound growth rate (CAGR) of 57 per cent per year over the past six years. The bank has also recorded its return on equity (ROE) ratio at over 30 per cent for three consecutive years, far exceeding the average rate of the Top 10 listed banks.

VIB’s annual profit growth in 2017-22. Source: Financial statements in 2016-22

VIB currently has the leading retail proportion in the industry thanks to its strategy of becoming the leading retail bank in terms of scale and quality. The bank’s outstanding retail loans account for over 90 per cent of its total loan portfolio. It also leads the market share in core businesses such as home loans, car purchases and credit cards. In 2022, VIB developed market-leading credit cards with outstanding product features and was first introduced in Việt Nam. The spending made by customers through VIB credit cards grew about nine times, from nearly VNĐ9 trillion in 2018 to VNĐ75 trillion in 2022. VIB also leads in Mastercard credit card growth rate in Việt Nam.

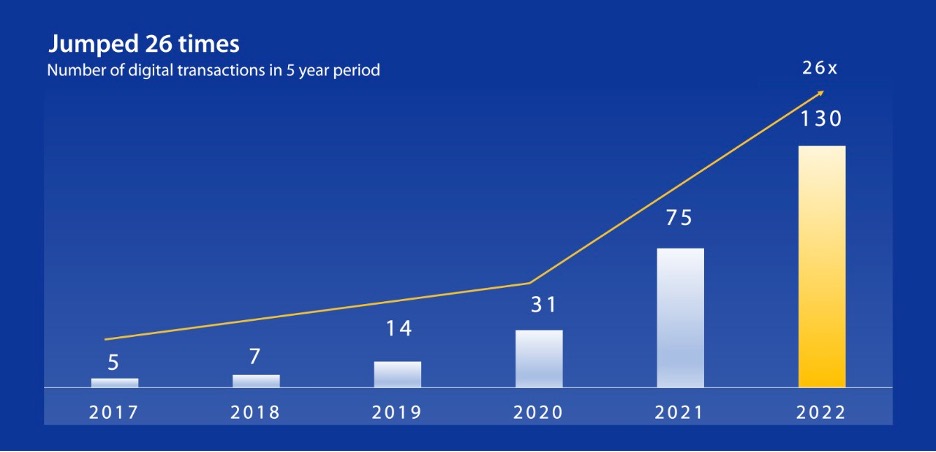

Sapphire account packages and MyVIB 2.0 digital banking application are considered VIB’s outstanding products and services that have helped the bank have one million new customers in 2022, reaching the milestone of four million earlier than expected. They have also contributed raising transaction rate on the bank’s digital platforms to over 130 million in 2022, up 73 per cent year-on-year or marking an increase of 26 times after five years.

Growth in a number of digital banking transactions in 2017-22. Source: VIB's management report

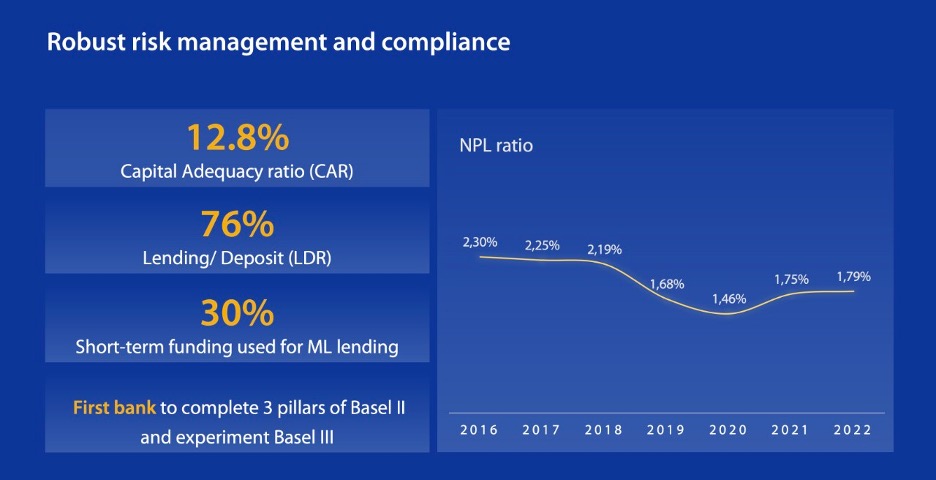

Robust risk management, increasing brand reputation

According to the Board of Directors report, VIB is the bank with the highest ratio of outstanding retail loans in the market with 90 per cent. It is also one of the banks with the lowest proportion of corporate bonds to total outstanding loans in the industry, accounting for only 0.8 per cent. In 2022, the State Bank of Việt Nam ranked VIB among the highest in the industry based on assessments of capital adequacy, asset quality, governance capacity, profitability efficiency, liquidity management, and other financial indicators. VIB has always adhered to the indicators set by the State bank and has pioneered in applying international standards, including Basel II, Basel III and IFRS. The independent assessment and analysis report of Moody's and Credit Suisse released in early 2023 showed that VIB was a bank with a safe and strong balance sheet. The ratio of corporate bonds and loans for real estate investment to equity was among the lowest in the Top 20 Vietnamese banks.

Some selected risk indicators of VIB. Source: VIB's management report

Approval of profit plan, dividend payment and charter capital increase

VIB's General Meeting of Shareholders allowed the goal to increase charter capital to over VNĐ25.36 trillion in 2023, up 20.36 per cent year-on-year. The plan to pay 35 per cent dividends to shareholders, with a maximum of 15 per cent cash dividends and 20 per cent bonus shares, was also approved by shareholders. According to VIB, the high dividend payout ratio has been maintained over the years, increasing shareholders' trust in the bank.

VIB's dividend payout ratio over the years. Source: Documents of the Annual General Meeting of Shareholders in 2017-22

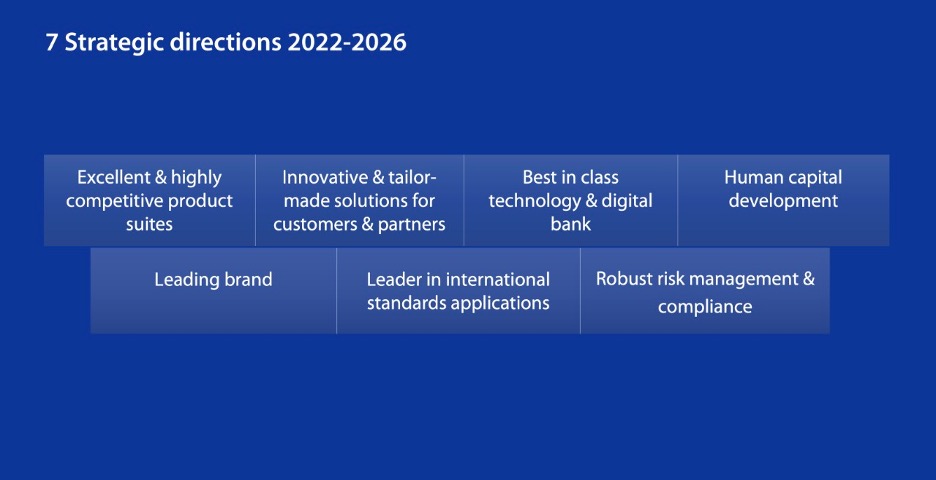

In the next period, VIB sets sustainable growth targets, pioneers a strong governance foundation and leads in digitalisation. The bank said it is always consistent to become a leading retail bank in terms of quality and scale in Việt Nam. VIB aims to attract 10 million customers by 2026, and archive an annual compound profit growth of 20-30 per cent each year from now to 2026, thereby sustainably increasing the market capitalisation for shareholders.

To this end, VIB’s Board of Directors will focus on seven directions as follow:

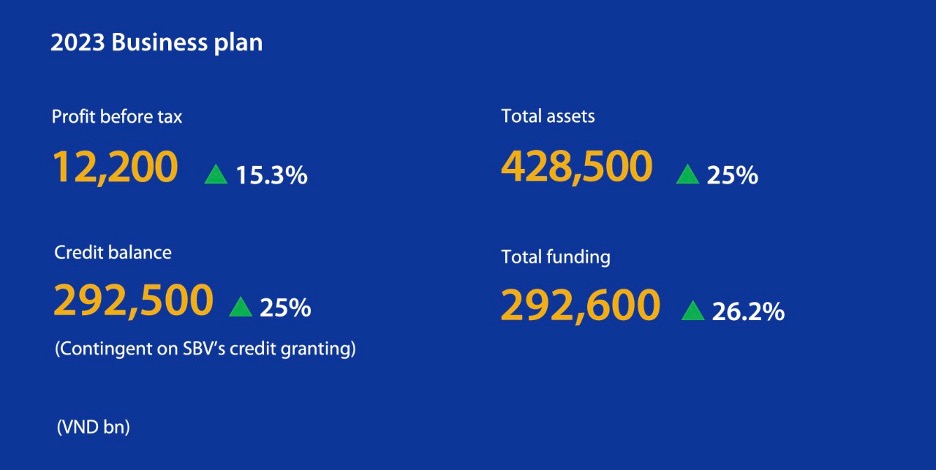

The General Meeting of Shareholders approved the business plan for 2023, including the growth of total assets, outstanding loans, capital mobilisation and profit. In particular, the growth rate of credit balance can be adjusted depending on the allowable limit of the State bank.

Approving the list of members of the Board of Directors and the Supervisory Board in term IX

At the meeting, shareholders voted to elect the Board of Directors and Supervisory Board for the IX term (2023-27). With a high consensus rate, they approved five members of the Board of Directors, including one independent member and two members of the Supervisory Board.